Navigating The Complexities Of Home Insurance And Flood Damage | WA Flood Insurance

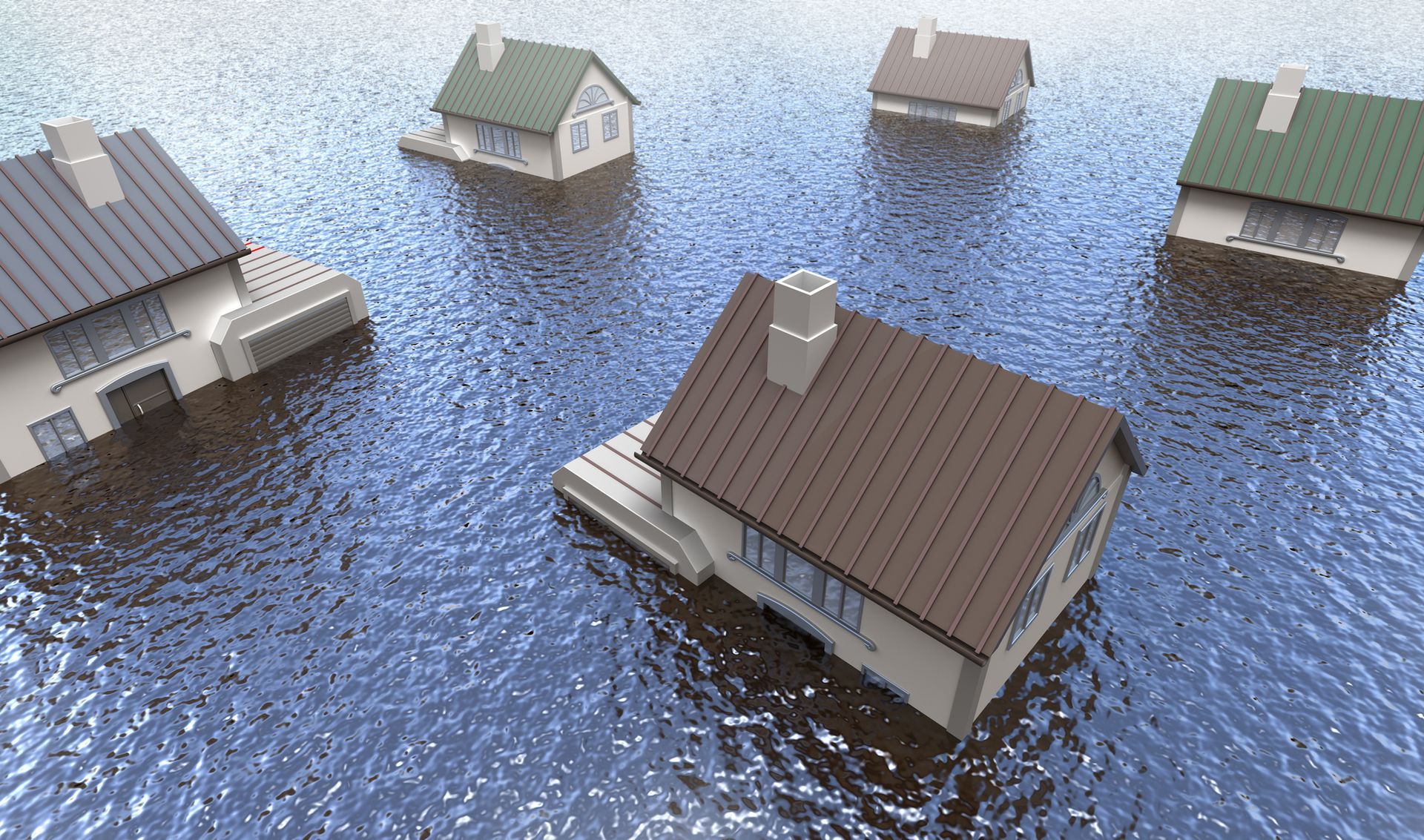

Home insurance and flood damage are complex matters that require careful consideration. It is essential for any potential homeowner to understand the different types of home insurance available, as well as how these policies may cover or exclude damages from flooding. This article will provide an overview of how to navigate the complexities of home insurance and flood damage in order to make informed decisions regarding coverage.

In particular,

Washington Flood Insurance will explain the various aspects related to obtaining adequate coverage for a property located in areas prone to flooding, including considerations such as purchasing additional flood insurance. Understanding policy language, assessing risk levels associated with floods, and other important factors when considering home insurance and flood damage.

Contact Us

We will get back to you as soon as possible.

Please try again later.

Furthermore, strategies for selecting suitable coverage options based on individual needs will be discussed so that homeowners can ensure they have appropriate protection against unexpected financial losses due to flooding.

Understanding The Different Types Of Home Insurance

The world of home insurance and flood damage can seem like a minefield to navigate. With countless policies, clauses, and exclusions on the market, it is easy to feel overwhelmed by the sheer amount of information out there. Navigating these complexities is no small feat; however, with a bit of knowledge about what you need and why, understanding the different types of home insurance can be easier than one might think! When analyzing costs associated with potential damages from floods or other disasters, it is important to consider all aspects of coverage that are included in each policy.

Homeowners should carefully review the specifics related to claims for water damage, as many policies only cover certain causes, such as burst pipes, rather than flooding caused by heavy rains or rising sea levels. Deductibles also play an important role in determining financial responsibility when filing a claim, so they should not be overlooked during this process.

It is essential to understand exactly what type of protection your current policy provides before making any decisions regarding additional coverage or filing any claims. Different companies have their own unique terms and conditions that may vary greatly depending on location and other factors, so researching thoroughly will help homeowners confirm which expenses would fall under their existing policy if needed. Knowing ahead of time whether repair work due to natural disasters will be covered will save money in the long run and ensure peace of mind for years to come.

Purchasing Additional Flood Insurance

When it comes to purchasing additional flood insurance, researching providers and reviewing costs are important components of the process. It is advisable to shop around for the best coverage options that are available in terms of price and the level of protection that various insurers offer. Flood insurance rates can vary significantly depending on a variety of factors, such as property location, home value, prior claims history, and deductibles chosen. Therefore, it is beneficial to compare offers from multiple providers before making a decision.

Homeowners should also be aware that some mortgage lenders may require borrowers to purchase additional flood insurance beyond what they currently have if their properties lie within designated high-risk areas. Furthermore, certain types of homes or dwelling units may not qualify for standard flood policies, so alternative coverage plans must be explored instead. It is generally recommended that homeowners in areas prone to flooding consult with an experienced agent who can help them identify suitable coverage options based on their individual needs and circumstances.

By taking this approach, one could save time and money while more effectively protecting their assets against potential losses due to floods.

Assessing Risk Levels Associated With Floods

Having considered the benefits of purchasing additional flood insurance, it is now time to assess the risk levels associated with floods. Floods are defined as an overflow of water onto normally dry land and can result from a number of factors, including heavy rain or snowmelt, dam failure, or hurricane-related storm surge. To evaluate these risks accurately and efficiently, homeowners must take various factors into account, including reviewing flood maps and evaluating elevation in relation to potential flooding areas.

- Topography and Hydrology. The risk of flooding depends a lot on the land's shape and how water moves through it. Low-lying places are more likely to flood, especially those near rivers, lakes, or the coast. The height, slope, and distance from water bodies can all affect how bad and how often floods might happen. By analyzing topographic and hydrological data, flood-prone places can be found and their risk levels can be estimated.

- Historical Flood Data. By looking at historical flood statistics, we can learn a lot about how often, how big, and how far floods spread in the past. This information helps experts and officials set up flood-risk zones and make predictions about what might happen in the future. Information like how often floods happen, where the floodplains are, and how they affected infrastructure and communities in the past can help figure out how dangerous different places are.

- Rainfall Patterns and Climate Change. Changes in temperature and the way it rains have a big effect on the risk of flooding. Changing weather trends, like more rain or stronger storms, can make it more likely that it will flood. Understanding local climate trends and forecasts can help you figure out how flood risk is changing and find areas that may be more likely to flood in the future.

- Infrastructure and Drainage System. It is very important that infrastructure and drainage systems work well to handle extra water during times of heavy rain or flooding. Well-designed and well-maintained drainage systems can reduce the risk of flooding by moving water away from places that are likely to flood. Evaluate the state and capacity of infrastructure and drainage systems to find out how well they can handle flooding. This helps get an accurate picture of the risk.

- Floodplain Mapping and Flood Insurance Rate Maps (FIRMs). Mapping floodplains means drawing lines around places that are likely to flood based on scientific data and hydrological modeling. Flood Insurance Rate Maps (FIRMs) are made with the help of this method. FIRMs show important information about flood zones, base flood elevations, and insurance risk ratings. FIRMs are used by insurance companies, individuals, and government agencies to figure out whether or not a property needs flood insurance, how much it should cost, and how vulnerable it is.

- Socioeconomic Factors. The risk of flooding is also affected by socioeconomic factors. In flood-prone places, things like a high population density, urbanization, and development can make people more vulnerable. When important facilities, like hospitals or power plants, are in flood-prone areas, the effects of flooding could be even worse. Assessing how socioeconomic factors and flood risk affect each other helps adopt targeted strategies to reduce flood risk and build strong communities.

Taking proactive steps prior to experiencing severe weather conditions helps ensure that families have peace of mind knowing they are fully prepared for future disasters.

Understanding Policy Language

Home insurance and flood damage policies are complex documents that require careful review. To understand policy language, one must first review the exclusions in detail before comparing rates to ensure they have chosen an appropriate plan for their needs. It is important to note that some home insurance policies do not provide coverage for flooding events or other natural disasters. When reviewing a policy's exclusions, it is essential to confirm whether flood damage is excluded from coverage as well as what specific types of water losses are covered under the policy, such as sewer backup or broken pipes.

Additionally, many policies will include limitations on how much money can be claimed per occurrence and may exclude certain items within a dwelling, like jewelry or electronics, so these should also be reviewed carefully. Comparing rates between different insurers can help determine which company offers the best value when looking at both price and coverage options. It is beneficial to compare deductibles, limits of liability, coverage details, and any discounts available to make sure you get the most comprehensive protection possible while still staying within budget constraints.

Selecting Suitable Coverage Options

Home insurance and flood damage can be complex topics to navigate. From reviewing costs to comparing providers and selecting suitable coverage options, it is easy to feel overwhelmed by the choices available. Yet with dedicated research into the different policies available, homeowners can have peace of mind knowing that they are adequately protected against unexpected damages.

When deciding on home insurance and flood damage coverage, it is important to review the costs associated with each option. Fortunately, there are many companies that offer competitive rates for all types of needs, from basic packages right up to comprehensive protection plans. Homeowners should also compare various providers in order to determine which one offers them the best value for money as well as reliable customer service.

Finally, when assessing their home insurance and flood damage policy requirements, homeowners must select an appropriate level of coverage that meets both their budget and future goals. It may take time to thoroughly investigate each provider before making a decision; however, this process will ensure individuals remain financially secure in times of hardship or extreme weather conditions.

Let Washington Flood & Quake Insurance Agency Help You Navigate Your Home Insurance Policy

In conclusion, home insurance and flood damage can be complex topics. Homeowners should take the time to understand the different types of policies available, purchase additional coverage if needed, assess their risk levels associated with floods, read policy language carefully, and select appropriate coverage options for their needs. It is essential that homeowners recognize the importance of taking these steps; it could be the difference between financial security and ruin in the case of a disaster. To make sure you are adequately protected against potential losses due to flooding, consider investing in reliable home insurance like a lifebuoy, ensuring your future will remain afloat no matter what comes your way.

Affordable Insurance With Personal Service - Local Agents & Brokers

CONTACT US

Phone: 206-759-2566

Insurance Services

Have Questions or Request A Quote

Contact Us

We will get back to you as soon as possible.

Please try again later.