Understanding Excess Flood Insurance Policies: Benefits and Cost | WA Flood Policy

Excess flood insurance policies can provide financial protection to property owners in the event of a disaster. Understanding the benefits and costs associated with these types of coverage is important for any policy analyst or potential policyholder.

Seattle Flood Insurance will evaluate excess flood insurance policies, outlining their advantages and disadvantages as they pertain to cost and risk management.

The main advantage of an excess flood insurance policy is that it offers extra coverage above and beyond what regular insurance plans do. It also offers peace of mind knowing that there are limits on how much money would be required to repair or replace damaged items due to flooding.

While this type of coverage does offer some benefits, it also carries certain risks that should be considered when evaluating whether or not to purchase such a policy. These include the possibility of paying more than necessary if claims exceed expectations, as well as uncertainty over future premiums and other fees associated with the policy itself.

Overview of Excess Flood Insurance

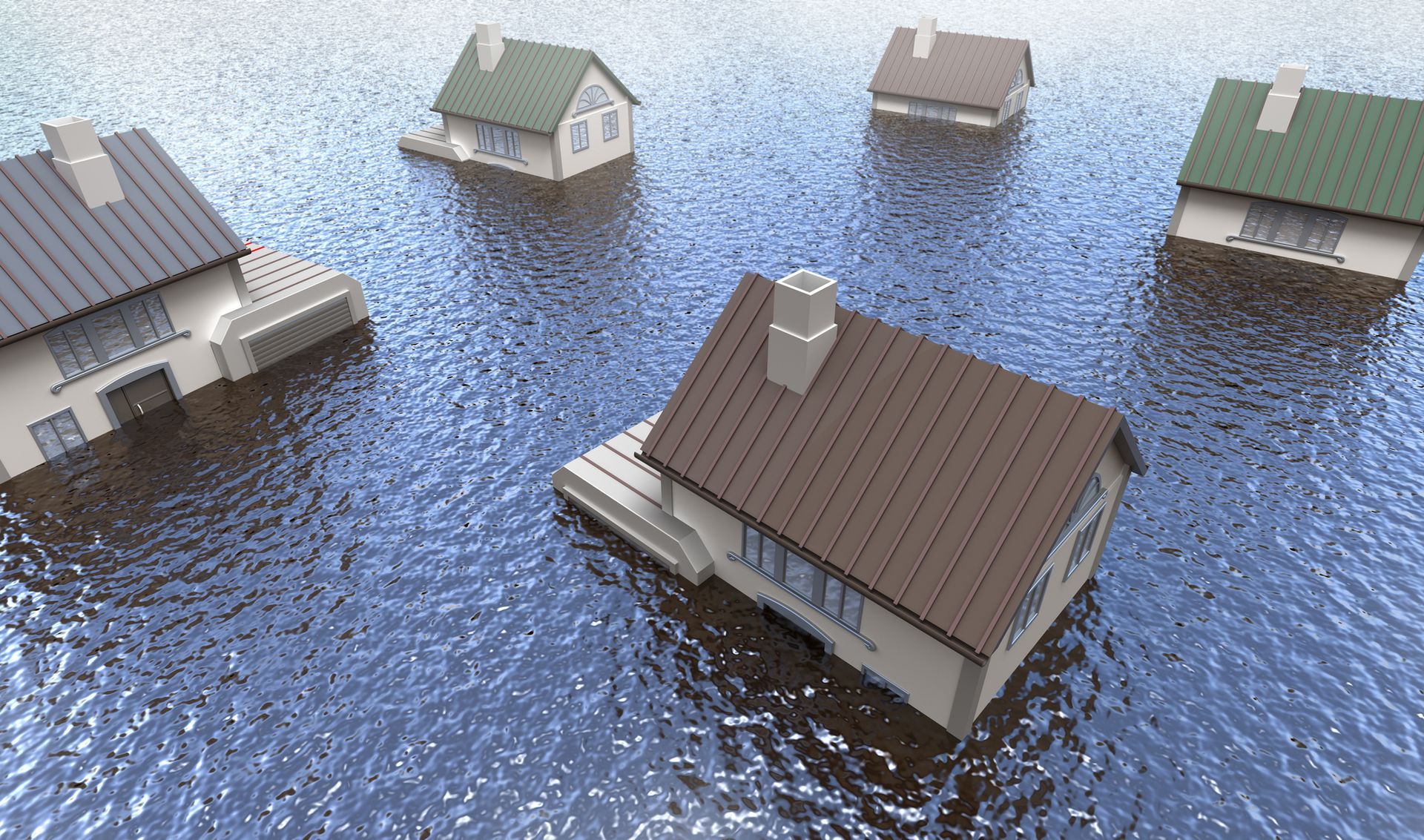

In the wake of an increasingly hazardous climate, excess flood insurance has become a necessary form of financial security for many. This policy's coverage offers protection from unforeseen floods and other natural disasters, providing homeowners with peace of mind in uncertain times. As such, it is important to understand both the benefits and costs associated with these policies.

Excess flood insurance provides comprehensive protection against any losses or damages caused by flooding that are not covered by standard

home insurance policies. In addition to this broad range of coverage, some carriers offer additional living expenses as well as replacement cost values when determining compensation for flooded homes. On top of all this, most policies come with low deductibles so that customers can receive their payments in a timely manner without being financially burdened.

While there are numerous advantages to purchasing excess flood insurance, consumers should be aware that there may be certain limitations on these types of policies. For example, many insurers limit the amount they will reimburse for damaged property depending on its age and condition at the time of the disaster event; they also have specific guidelines regarding what constitutes damage due to flooding versus water-related wear and tear over time.

Additionally, some companies exclude certain areas entirely from their coverage if they are deemed too risky to insure against potential floods.

Clearly, then, taking out an excess flood insurance policy comes with both pros and cons, which should be carefully weighed before committing to purchasing one. Understanding exactly what is covered under each plan is essential for making an informed decision about how best to protect your home and finances from disaster events like floods.

Benefits of an Excess Flood Insurance Policy

Excess flood insurance policies provide additional financial protection in the event of catastrophic damage. Given that it offers more coverage than traditional homeowners insurance, such a policy can be advantageous to people who own properties in high-risk areas.

The primary advantage of an excess flood insurance policy is that it allows for additional compensation if flooding results in damages above and beyond the limits set forth by a standard home insurance policy. This type of coverage may also include reimbursement for repairs related to consequential damage such as mold growth or structural instability due to water infiltration.

In addition to providing extra assurance against large-scale losses from floods, having an excess flood insurance policy can give peace of mind knowing that any necessary repairs will be covered regardless of their cost.

The following are some key points about this type of coverage:

- Coverage for damages exceeding the limit set on a regular homeowner’s policy

- Reimbursement for consequential damage resulting from the flood

- peace of mind associated with extensive financial protection should there be major flooding.

When it comes to minimizing financial loss resulting from such disasters, an excess flood insurance policy can make all the difference. It offers valuable protection against potential costs associated with catastrophic flooding events.

Potential Risks of an Excess Flood Insurance Policy

The potential risks of investing in an excess flood insurance policy are immense and far-reaching. Weather patterns can be unpredictable, and catastrophic flooding events can cause immeasurable damage to a property. The cost of repairs could easily exceed the coverage that is provided by basic policies, leaving homeowners exposed to hefty financial losses if they have not invested in extra protection.

Flood mitigation strategies such as levees and dams offer some degree of protection from flooding, but these measures may prove inadequate or even obsolete when faced with extreme weather conditions. For this reason, it is essential for homeowners to consider purchasing an excess flood insurance policy that covers damages beyond what their current plan offers, especially those living in areas prone to rising water levels due to heavy rainfall or melting snow.

Excess flood insurance policies are worth considering, as they provide peace of mind should disaster strike; however, individuals must also take into account whether the premiums required outweigh any potential financial gains made through suffering less severe damage during floods. Those at risk should weigh up all options carefully before deciding on taking out an additional policy.

Calculating the Cost of an Excess Flood Insurance Policy

When assessing the cost of an excess flood insurance policy, there are several factors to consider. Insurance premiums can vary widely depending on a number of criteria, including location and risk assessment. Insureds should also be aware that rate increases may occur as a result of changes in their property or coverage levels.

Insurance companies often use sophisticated models to determine rates for both initial policies and rate increases over time. These models generally include components such as current flood conditions and past flooding events in the area where the property is located. Additionally, some insurers may offer discounts or credits based on certain criteria, such as having installed mitigation features like sump pumps or storm shutters.

For those considering purchasing an excess flood insurance policy, it is important to research the limits and available options carefully before making a decision. When evaluating potential policies, insureds should compare not only premium costs but also deductibles, limits, and any additional risks associated with the proposed plan that could lead to increased premiums in the future.

In addition, getting quotes from multiple providers will provide insight into how different carriers assess risk when setting rates. Consider the quality and type of coverage offered.

Factors to Consider When Purchasing an Excess Flood Insurance Policy

An excess flood insurance policy from the National Flood Insurance Program (NFIP) provides superior protection against floods that are bigger than what a standard flood insurance policy would typically cover. This kind of insurance frequently covers flooding-related structural damage to walls, floors, ceilings, fixtures, and personal property harmed by water entering through windows or doors.

In order to secure adequate protection at a reasonable price point, consumers must assess their individual needs carefully when selecting an appropriate policy. It is essential to research all potential providers thoroughly before committing to any particular product and to pay close attention to exactly what is offered in terms of coverage limits and deductibles within each plan option.

- Your property location

When buying extra flood insurance, the location of your home is the first thing to think about. If you live in an area where flooding is likely, you might want to buy extra flood insurance. Places that are close to rivers, lakes, or the ocean have a high chance of flooding.

- Your property value

When buying extra flood insurance, it's also important to think about how much your home is worth. If you own a property that is worth a lot, you might want to buy insurance that covers the full value of your property. If your property suffers flooding damage, the coverage limit on your policy ought to be sufficient to cover the costs of renovation or repair.

- The coverage limits

Another important thing to think about is the coverage limits of an excess flood insurance policy. Make sure you are aware of the policy's coverage limits and whether they are sufficient to pay for the cost of repairing or rebuilding your property if it suffers flooding damage. You should also check to see if the insurance pays for extra living costs, such as temporary housing, while the house is being fixed or rebuilt.

- Deductibles

Extra flood insurance plans have deductibles, just like other types of insurance. The deductible is the amount you have to pay out of your own pocket before your insurance policy starts to cover you. When buying extra flood insurance, think about how much it will cost and if you can afford it. Most of the time, a higher deductible means lower premiums, but if there's a flood, you'll have to pay more out of pocket.

- The insurance provider

Another important thing to think about is the insurance company you choose. Choose an insurance company that has a good reputation and a history of paying claims on time and fairly. Check the company's financial stability and ratings from independent rating agencies to make sure they can meet their responsibilities in case of a major flood.

Careful consideration should be given to the expected maximum inundation level on one's property along with other relevant factors prior to making any decisions regarding which plan best meets their needs.

Washington Flood Insurance

Excess flood insurance policies provide an additional layer of protection for homeowners in areas prone to flooding. The benefits, including increased coverage and financial stability, are clear.

However, potential risks should be taken into account when purchasing a policy. Careful consideration must also be given to the cost associated with the policy, as well as other factors such as deductibles and waiting periods, before making a purchase decision.

All in all, excess flood insurance can offer peace of mind to those living in vulnerable locations; however, each situation is unique and deserves careful research and evaluation prior to purchase. As the ancient proverb says, "An ounce of prevention is worth a pound of cure."

Contact Us

We will get back to you as soon as possible.

Please try again later.

Affordable Insurance With Personal Service - Local Agents & Brokers

CONTACT US

Phone: 206-759-2566

Insurance Services

Have Questions or Request A Quote

Contact Us

We will get back to you as soon as possible.

Please try again later.