Understanding Coverage and Exclusions Of Flood Insurance | WA Flood Insurance

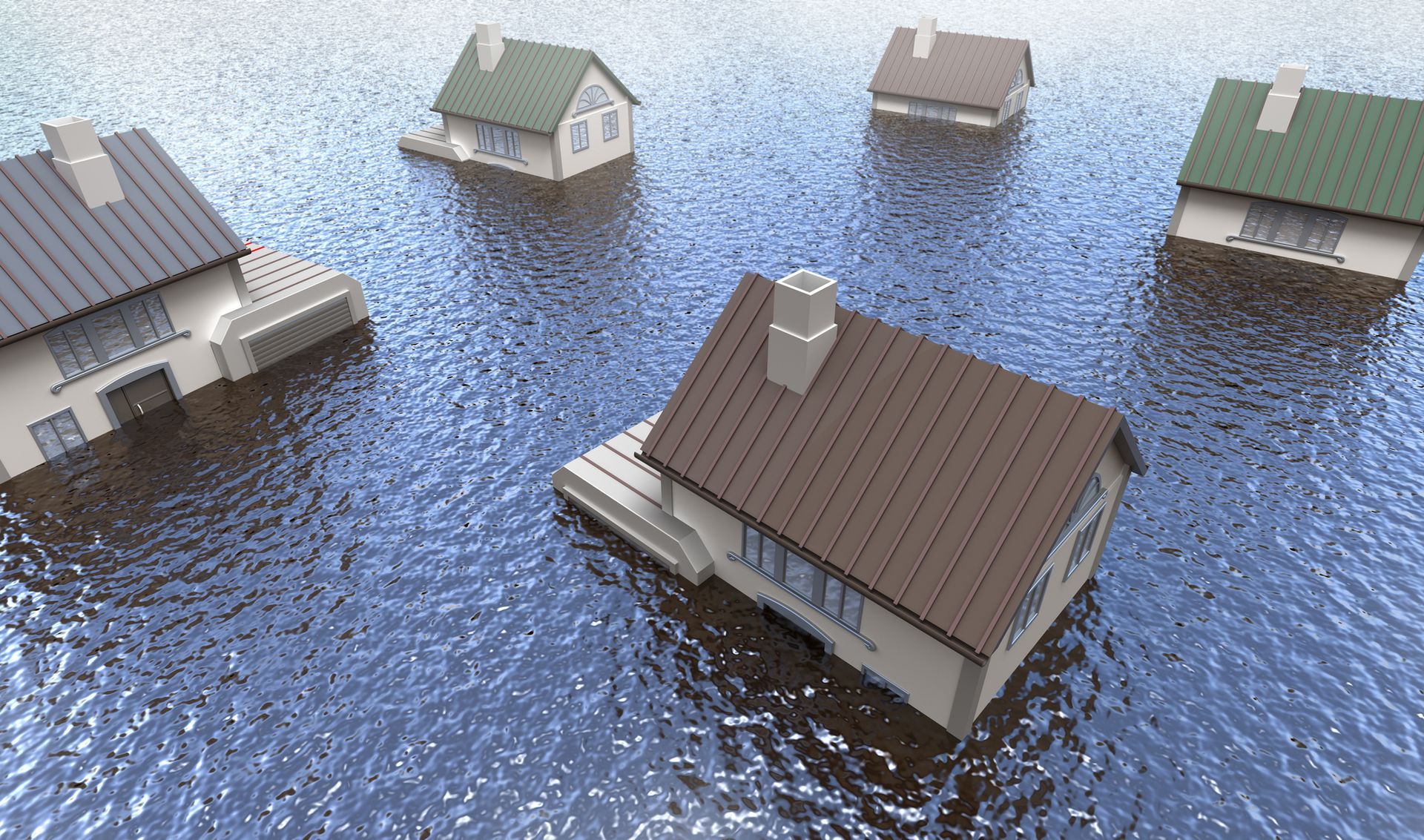

Floods can be as devastating to a person’s home and possessions as a wildfire, but unlike wildfires, floods are not always avoidable. Homeowners can protect their assets from the financial ruin of a catastrophic event by understanding what flood insurance covers. Like a beacon in the night, understanding flood coverage is essential for any homeowner who wants to stay afloat when disaster strikes. For more information regarding your policy, contact Washington Flood Insurance Agency for your review or free quote!

The National Flood Insurance Program (NFIP) defines flooding as “a general and temporary condition where two or more acres of normally dry land or two or more properties are inundated by water or mudflow”. Homeowners should note that while this definition applies to most cases, it may not accurately reflect all scenarios related to flooding; individual policies should be carefully reviewed with an eye on specific details before signing off on them.

Contact Us

We will get back to you as soon as possible.

Please try again later.

It is crucial for those who have experienced flooding to be aware of the types of damage that their policy covers. Standard NFIP-backed flood insurance generally covers both structural damages and personal belongings damaged directly due to flooding; however, there are several exclusions that must be taken into account when determining the overall scope of coverage provided. In order for readers to make informed decisions about defending their property from potential disasters in the future, this article will give them an overview of what flood insurance policies typically cover and don't.

Overview Of Flood Insurance

Flood insurance is a type of protection that helps homeowners and business owners financially recover from flooding events. This coverage can provide financial support for repairs to damaged structures as well as reimbursements for lost or damaged personal property. When other policies, such as homeowner's insurance or commercial property insurance, do not cover flood damage, flood insurance offers an additional layer of protection.

It's crucial to understand the areas of your home or business that flood insurance covers and those that it doesn't when making plans for potential risks related to flooding. Generally speaking, most types of flood insurance cover damages caused directly by rising water levels due to heavy rain, melting snow and ice dams, severe coastal storms, and overflowing rivers or stream beds. However, there may be some circumstances where only certain aspects of flood-related damage will be reimbursed, so it's important to check with your insurer about any restrictions on coverage limits before purchasing a policy.

What Does Flood Insurance Protect?

Flood insurance provides coverage against financial losses caused by water damage to flooded homes, buildings, and personal possessions. In general, flood insurance offers protection for the following:

- Building contents such as carpets, furniture, electrical appliances, and fixtures

- Personal possessions, including clothing and jewelry

- Financial losses that occur from flooding of a property due to rising or overflowing waters

It is important to note that while most basic policies offer coverage for these items, some may not be included in your particular policy. Therefore, it is crucial to carefully read the fine print of your policy before enrolling so that you are aware of everything it covers. Furthermore, keep in mind that flood insurance does not cover any additional costs incurred during repairs or replacements due to mold or other types of water damage. Therefore, if you live in an area prone to flooding, it is highly recommended that you take out a comprehensive flood insurance policy that covers all eventualities should the worst happen.

Exclusions From Coverage

Flood insurance typically does not cover damages caused by moisture, mildew, or mold that result from long-term or repeated exposure to humidity and wetness. Damage resulting from faulty construction, design, maintenance, or repair of a property is also excluded from coverage. Additionally, normal wear and tear on the structure or its foundation are not covered.

In addition to these exclusions, flood insurance also excludes certain properties such as sea-walls and their foundations, walkways leading to the sea wall, bulkheads and their foundations attached to shorelines in tidal areas, swimming pools and related structures built into the ground in tidal areas; any part of a building which is below ground level (e.g., basements) located in coastal barrier resource systems designated under federal law; trees shrubs lawns fences patios decks seawalls hot tubs gazebos docks piers retaining walls boats vehicles sand beaches beach nourishment dikes breakwaters marinas levees fill dirt canals culverts bridges dams sidewalks driveways parking lots sewers manholes catch basins pumps tanks septic tanks wells outdoor equipment motors furniture appliances buildings other than detached one- and two-family dwellings located above the mean high water line within an identified special flood hazard area. Additionally, local codes or ordinances may place restrictions on certain locations due to their environmental impact.

How To Obtain Flood Insurance

Do you want to protect your home or business from flooding? Getting flood insurance can help offer financial protection against the harm that floods cause. Flood insurance policies are available through private insurers and the National Flood Insurance Program (NFIP). When buying flood insurance, it is important to understand what coverage is included in a policy as well as any associated costs.

Flood insurance policies typically cover both structural and contents losses, such as personal property items like furniture and electronic equipment. Depending on the type of policy purchased, certain exclusions may apply, including losses related to surface water, mudflow, or sewer backup. The cost of flood insurance will vary depending on a number of factors, such as location and risk level. Homeowners should compare quotes from multiple insurers when obtaining flood insurance to ensure they get the best rate for their particular situation.

In addition to purchasing an NFIP-backed policy through a private insurer, homeowners can also purchase stand-alone policies that supplement traditional homeowner’s policies with additional coverage specific to flooding. It is important to read all terms and conditions carefully when selecting a policy so that you have an understanding of exactly what types of damages are covered under the policy. Understanding this information ahead of time will make filing claims easier if needed in the future.

Contact Seattle Flood Insurance For Affordable Coverage

Floods are one of the most common and destructive natural disasters. With proper coverage, however, it is possible to reduce the financial risks associated with floods. Flood insurance helps protect homeowners from potentially devastating losses due to flooding. It covers damage that occurs when water inundates a structure or its contents as a result of heavy rains, overflowing rivers or lakes, snowmelt, tsunamis, mudslides, and other sources of flooding.

Although different policies may vary in terms of their exact coverage limitations and exclusions, flood insurance typically offers protection for physical damages caused by rising waters up to the policy limits set forth in the contract. Excluded items include outdoor property such as swimming pools and detached structures like garages; these items must be purchased separately if desired coverage is needed. Homeowners can obtain flood insurance through an independent agent who specializes in this type of risk or directly from the National Flood Insurance Program (NFIP).

In order to ensure adequate protection against potential losses due to flooding events, homeowners should be aware of what their flood insurance policy covers. Those living in high-risk areas should consider purchasing additional coverage beyond what is available through the NFIP or private insurers in order to fully protect themselves financially from any unexpected expenses resulting from flooding incidents. By familiarizing themselves with the details of their coverage. Before signing on with a provider, homeowners can make sure they have the right level of protection at an affordable rate before disaster strikes.

Affordable Insurance With Personal Service - Local Agents & Brokers

CONTACT US

Phone: 206-759-2566

Insurance Services

Have Questions or Request A Quote

Contact Us

We will get back to you as soon as possible.

Please try again later.