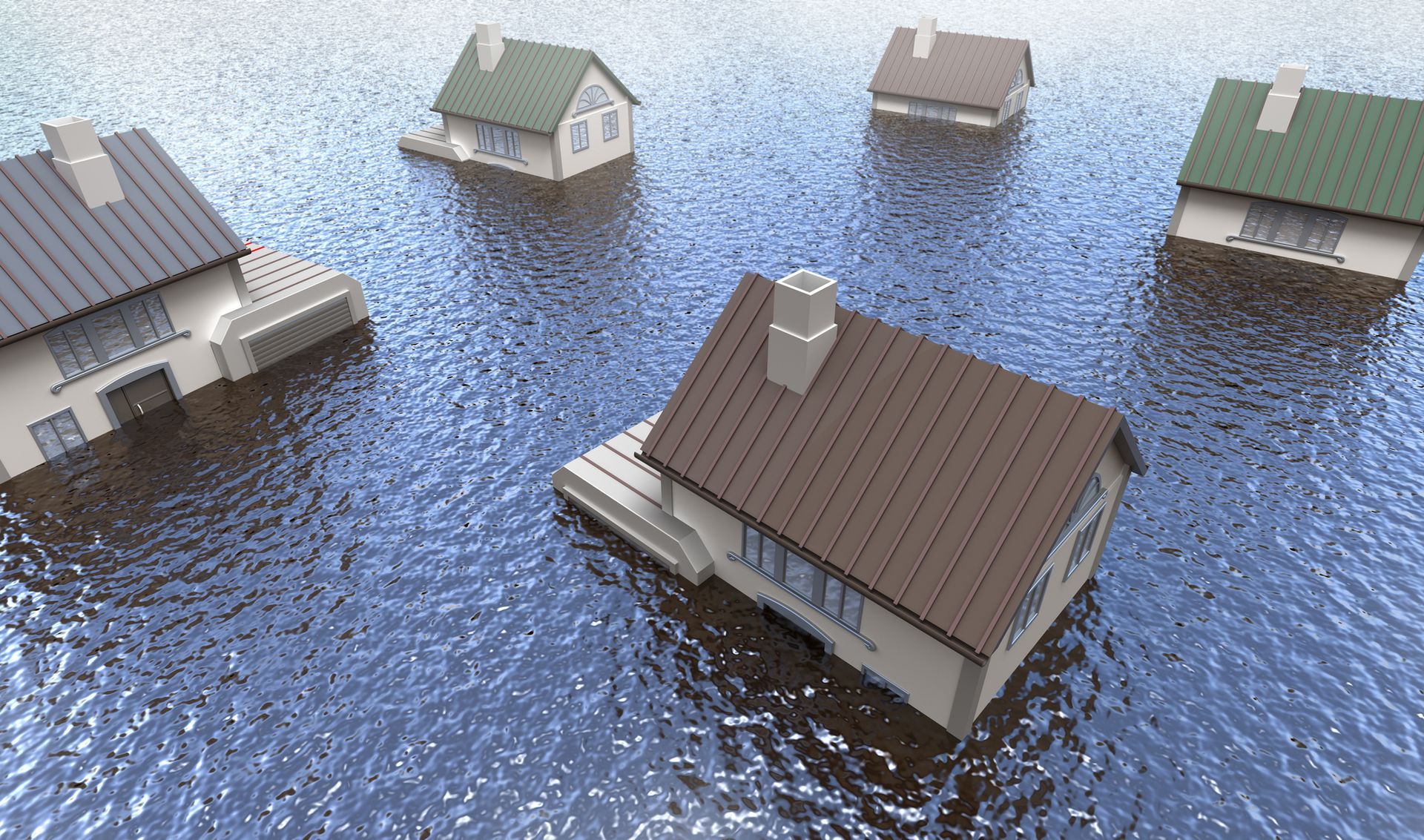

The Advantages And Disadvantages Of Home Insurance Including Flood Cover

Home insurance is a critical component of any homeowner's financial protection plan. It is essential to understand the advantages and disadvantages associated with home insurance, including flood coverage.

This article provides an overview of these benefits and drawbacks, allowing homeowners to make informed decisions regarding their policy selection. The specifics of home insurance policies can vary greatly depending upon several factors such as coverage levels, deductibles, exclusions, additional riders, etc.

To ensure that all policyholders are adequately protected against unexpected events like floods or other natural disasters, most insurers offer optional

flood coverage. There may be both pros and cons to selecting this type of policy; understanding them is key to making sound decisions about your home insurance needs.

Contact Us

We will get back to you as soon as possible.

Please try again later.

Coverage Levels

Home insurance is a type of property insurance that protects against losses and damages to a person's home from occurrences like fire, theft, or flooding. It also protects against accidents at home. When looking into whether home insurance with flood coverage is the right option for you, it can be helpful to understand what coverage levels are available and how they may affect premium costs.

The first step in assessing which level of coverage best suits your needs is to complete a risk assessment. This helps identify any potential risks associated with your home so that you can ensure they are taken into consideration when deciding on the type and level of coverage required. For instance, if you live in an area prone to flooding, selecting a policy with flood coverage would make sense. On the other hand, if there is no history of flooding in your neighborhood, opting out of this additional coverage could help reduce premium costs significantly.

When considering taking out home insurance with flood coverage, it is important to investigate all options thoroughly before choosing a particular policy in order to determine whether it meets both your requirements and budget constraints adequately. Taking time to compare different policies will enable you to find one that offers adequate protection at affordable rates - ensuring peace-of-mind should the worst happen.

Deductibles And Exclusions

Deductibles and exclusions are important parts of home insurance. A deductible is an amount that the policyholder must pay out-of-pocket before their coverage kicks in. The higher the deductible, the lower the cost of premiums; however, it also means more money will be needed to cover any claims that occur. Additionally, each policy has its own limit for how much can be claimed.

It's important to understand what your insurance covers as well as any exclusions included in the policy. Home insurance policies typically exclude damage from flooding or earthquakes - though some providers do offer specialized coverage for these events at a premium rate. Similarly, costs associated with maintenance, such as repairing shingles on roofs, may not be covered in certain cases if there was prior wear and tear or negligence on the homeowner's part.

When considering home insurance, make sure you understand:

- How much deductibles cost under different policies

- What type of damages are and aren't covered by specific plans

- Policy limits according to individual needs

- Whether there are any discounts available

Additional Riders

In many cases, homeowners may want to purchase additional riders for their home insurance policy. These are optional coverage options that can be added to the main policy and provide additional protection beyond what is typically included in a basic plan. Riders are available for specific events such as flooding or earthquakes and will cover any costs associated with damages caused by these events up to the specified limits of the rider.

- Water Damage Rider: One of the most common and expensive things that can happen to a home is water damage. Standard home insurance plans may cover water damage that happens suddenly or by accident, but they usually don't cover damage that happens slowly or keeps happening. When you add a "water damage rider" to your policy, it covers damage caused by leaking pipes, backed-up sewers, and other water-related problems. This rider can be especially helpful for people who live in flood-prone places or have older plumbing systems.

- Personal Articles Floater: High-value personal items like jewelry, art, and collectibles aren't always covered by standard home insurance plans. A personal articles floater rider can be added to a policy if the value of these things is more than what the policy covers. This rider gives extra coverage for certain things, making sure they are well taken care of if they are lost, stolen, or damaged. By making a list and getting an estimate of these valuable items, homeowners can get the security they need.

- Earthquake Rider: Earthquakes can do a lot of damage to houses, which can cost a lot to fix or even cause them to be completely destroyed. Most standard home insurance plans do not cover earthquakes, which is a shame. But homeowners who live in areas that are prone to earthquakes can add a "rider" to their insurance to cover earthquakes. This rider covers damage caused by earthquakes, such as damage to buildings, loss of personal property, and extra living costs. Homeowners who live in places with a high risk of earthquakes may want to buy an earthquake rider.

- Home Business Rider: As the number of people who work from home and start their own businesses grows, more and more people are running businesses from their homes. But most standard home insurance policies don't cover business-related tasks or only cover them in a limited way. By adding a "home business rider," a homeowner can stretch their coverage to include business equipment, liability protection, and even coverage for business interruption. This rider makes sure that both personal and business assets are well covered, giving those who run a business from home peace of mind.

- Identity Theft Rider: In this digital age, identity theft is becoming a bigger problem. Even though some homeowners insurance plans may cover some parts of identity theft, like credit card fraud, they usually don't cover everything. By adding an identity theft rider to their policy, homeowners can get more coverage for costs like restoring their name, paying legal fees, and making up for financial losses caused by identity theft. This rider is a good way to protect yourself from a crime that is becoming more common and complicated.

When considering extra coverage through riders, it is wise to review all details regarding eligibility requirements and policy limits before signing an agreement. Understanding these parameters beforehand will help ensure that you get appropriate coverage should you need to file a claim related to one of these add-on services at some point down the road.

Pros And Cons Of Flood Coverage

A homeowner in the southeastern United States recently experienced record rainfall and flooding that caused significant damage to their property. This case study illustrates the importance of flood coverage on home insurance policies, as it provides financial protection from costly repairs due to water damage. Flood coverage is an important consideration when selecting a home insurance policy because it can help protect against damages incurred during substantial rainstorms or floods.

However, premiums for this type of coverage may be higher than those for other types of insurance coverage included in a policy. It is also important to consider the terms and conditions associated with the specific policy, since some policies include more comprehensive coverage than others. When evaluating flood coverage options for a home insurance policy, homeowners should take into account potential risks, such as those posed by extreme weather events, as well as related expenses like premium costs and any additional fees associated with the policy itself.

Carefully considering these factors will ensure that homeowners have adequate protection from disaster-related losses without overspending on unnecessary features or services.

Shopping For Home Insurance

Shopping for home insurance can be daunting, but it is an important part of protecting your investment. To ensure you are getting the best coverage at a competitive price, consider comparing prices and policy options from different companies. Comparing prices between providers allows you to identify any discrepancies in cost that could save you money over time.

The next step when shopping for home insurance is to compare policy coverage. This involves reviewing details such as how much each company will pay out in the event of a claim, what types of damages are covered, and if there is any additional coverage for flooding or other natural disasters. It’s also important to review the deductibles associated with the policy and decide if an increase or decrease would better suit your needs.

When selecting a home insurance provider, it’s wise to research their customer service ratings as well as read reviews from current customers on their overall satisfaction with the company. Additionally, look into the financial strength of each insurer since this indicates whether they have enough assets available to payout claims quickly and efficiently should you need them too. Taking all these factors into consideration before making a decision can help ensure you get the right policy for your individual situation.

Get Homeowner Insurance with Flood Coverage with Washington Flood & Quake Insurance Agency

Home insurance is a vital part of protecting your most valuable asset. It can provide peace of mind and financial security in the event of damage or loss due to an unforeseen event.

When shopping for home insurance, it’s important to consider coverage levels, deductibles and exclusions, additional riders, and the pros and cons of flood coverage. For more information, contact

Homeowners Insurance Washington.

Ultimately, by having an understanding of what to look for when purchasing home insurance, you are setting yourself up for success! As the old saying goes: “An ounce of prevention is worth a pound of cure.' and by being prepared, you can help protect yourself from potential losses due to flooding.

Affordable Insurance With Personal Service - Local Agents & Brokers

CONTACT US

Phone: 206-759-2566

Insurance Services

Have Questions or Request A Quote

Contact Us

We will get back to you as soon as possible.

Please try again later.